Gambling Win Loss Statement Taxes

- Win Loss Gambling Statement For Taxes

- Gambling Win Loss Statement Taxes

- Gambling Win Loss Statement Taxes

Strategies to help you keep more of what you win

by Basil Nestor

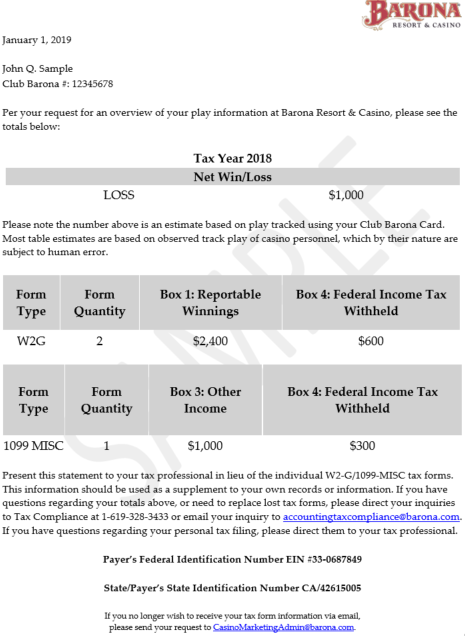

Absolutely, just make sure it includes all wins and losses separately and is not a combined number. You should show your gambling winnings as income and then your gambling losses as an itemized deduction, if you qualify.

- Notably, the win-loss statements reflect that petitioners had gambling winnings totaling $115,142, while the Forms W–2G provide that petitioners had total gambling winnings of $322,500 In other words, Judge Wherry relied upon casino win/loss statements to impeach the credibility of the taxpayers’ other evidence.

- You can use your losses to offset your gambling income, but you can't use any losses that are left over from your other sources of income. You might have spent $5,000 to win $2,000, but you can't deduct that $5,000—or even the $3,000 difference. You're limited to a deduction equal to the $2,000 you won.

- The rule for claiming gambling losses is that you can only claim up to the dollar amount you won gambling. If Form 1099G from the IRS shows gambling winnings of $5,000, you can claim losses of no more than $5,000, even if your losses were far greater. Before you can begin your Wisconsin state tax return you must complete your federal income tax.

Gambling income is taxed like regular income, so you may owe substantial money unless you can prove that your gambling activities generated an offsetting loss.

It’s spring…which means get ready to pay gambling taxes!

Gambling taxes, you say? Yes, you must pay taxes on your gambling income. And if you don’t plan carefully, you may have to pay taxes even if you’re a net loser.

Many players are unaware of this rule. There is no low-threshold limit on taxable winnings. Theoretically, you owe tax on every profitable bet, even if your income is only one lone dollar. Of course, the U.S. Internal Revenue Service won’t come after you for one humble buck. But if you’re a regular casino player, you will leave a paper trail that may detail substantial winnings even if you’re a net loser. And the IRS will want a share of those supposed profits. Scary, huh?

Here’s how it works…

Big Brother Is Watching

By law, casinos in the United States use IRS form W-2G to report jackpots and bingo wins of $1,200 and over ($1,500 and over for live keno). If you only play tables, you won’t run into W-2G reports except if you win a progressive jackpot on a side bet, or in a tournament when the payoff is more than 300 times greater than the entry fee.

But table players will bump into other systems designed to track gambling income. When a player has cash transactions that reach $10,000 per day or above, a casino is required to fill out a currency transaction report (CTR) which is a U.S. Treasury form. This necessarily involves the player, because a floor person asks for identification including a social security number. Failure to provide this information doesn’t prevent the report from being filed, but in some circumstances it does cause the casino to file an additional U.S. Treasury report regarding suspicious activity; this is called a SARC. Yup. The IRS has every angle covered.

And keep in mind that these reports are about cash transactions. Non-cash transactions involving chips, checks, and wire transfers have their own paper trails.

Here’s where it gets sticky. The government is interested in tracking income, but not losses. And that creates…

Tax Troubles For Net Losers

Let’s say you mostly play blackjack and video poker, and last year you received multiple W-2Gs totaling $15,000 for video poker jackpots. But you actually had a net loss of $5,000 playing video poker, and another $5,000 net loss playing blackjack. Your net loss for the year is $10,000. But the IRS doesn’t know that. They think you earned $15,000 gambling last year, and they want their cut of the profits.

Gambling income is taxed like regular income, so you may owe substantial money unless you can prove that your gambling activities generated an offsetting loss.

Unfortunately, deducting losses isn’t always a simple process. The first hurdle is that you can deduct losses, but only up to the amount of your gambling profits, and the net effect may bump you into a higher tax bracket. Why? Because tax rules say you cannot directly subtract a loss from profit and declare the difference, or declare nothing if you have a net loss. No, you must first declare all your wins as income.

Continuing with our example, if you want to deduct gambling losses, you must declare the entire $15,000 you won (higher tax bracket), then separately deduct $15,000.

And for every dollar you deduct, the IRS expects you to keep detailed records.

The Pen Is Mightier Than the Audit

The process is the same for net winners and net losers. If you have winnings to declare and want to keep more money, save anything with an amount on it. Begin with written reports generated by the casino. These include keno and sportsbook tickets, tournament-entry tickets, and any other receipts that show your action. Also remember that most casinos provide annual win-loss statements for their club members.

Win Loss Gambling Statement For Taxes

Collect ATM and debit receipts, bank statements, credit card receipts, cancelled checks, and other items that show your gambling transactions.

In addition, IRS Publication 529 says, “You must keep an accurate diary or similar record of your losses and winnings.”

The IRS specifically requests that your diary contain the following:

* The date and type of your specific wager or wagering activity.

* The name and address or location of the gambling establishment.

* The names of other persons present with you at the gambling establishment.

* The amount(s) you won or lost.

It sounds like a lot of work, but you can jot down the essentials on a piece of paper or on your phone/PDA in about 30 seconds. The IRS “suggests” that you also record the time of day and the table number or the machine number of the game you were playing.

Be practical, and don’t fret if you win $20 on a blackjack game waiting for your spouse at a table near the bathrooms. But at least make an effort to record wins and losses over $100.

By the way, a diary is useful not only for tax purposes, but also as way to audit your gambling strategies. Are you really playing a profitable game, or are you blowing through Ben Franklins like your wallet is a wind tunnel? The diary will tell you.

As with all things involving taxes, the subject has nuances and complications. Talk to a tax professional if you have questions about deductions, or read IRS Publication 529.

Remember, every dollar you track may be money saved from the tax man. Now is the time to start a diary for 2011. You won the money. You deserve it. Keep every dollar that you can.

Enjoy the game!

Basil Nestor is author of The Smarter Bet Guide to Blackjack, Playboy’s Complete Guide to Casino Gambling, and other comprehensive gambling guides. Got a question? Visit SmarterBet.com and drop him a line.

The IRS isn’t leaving gambling reporting to chance. It has issued new final regulations clarifying and expanding the rules for payors of slot, bingo and keno winnings. Most notably, in response to an outcry from the gambling industry, higher ...

The IRS isn’t leaving gambling reporting to chance. It has issued new final regulations clarifying and expanding the rules for payors of slot, bingo and keno winnings. Most notably, in response to an outcry from the gambling industry, higher thresholds for reporting responsibilities were retained (IRS Reg. 1.6401-10, 12/29/16).

“Commentators overwhelmingly opposed the idea of reducing these reporting thresholds. Payors opposed lowering the thresholds because it would result in more reporting, which would increase compliance burdens for the industry,” said the IRS in the regulations. “In fact, many commentators suggested that rather than reducing the current thresholds, they should be increased to account for inflation. These final regulations do not change the existing reporting thresholds for bingo, keno, and slot machine play.”

For taxpayers, gambling winnings are treated as taxable income on federal income tax returns, but the tax may be offset by losses up to the amount of the winnings. For example, if you win $5,000 during the year and incur losses of $4,500 in the same year, you owe tax on only $500. The losses are reported on Schedule A, but aren’t subject to the usual 2%-of-AGI floor for miscellaneous deductions.

For businesses, information reporting is required for payments of $600 or more to a taxpayer during the year. While temporary regulations had boosted the reporting thresholds for winnings from bingo games and slot machines to $1,200 and $1,500 for keno games, proposals would have lowered these amounts back to $600.

Gambling Win Loss Statement Taxes

The information is reported on Form W-2G, “Certain Gambling Winnings,” which must be filed by February 28 of the following year; March 31, if filed electronically.

Now the new regulations hold the line on the reporting thresholds for bingo, slots and keno games. The regs also retained the rules, with minor modifications, on identifying information that must be provided by gamblers. In addition, they adopted an “aggregate reporting” rule, with winnings for a single gambling session being allowed as an alternative to reporting each win that exceeds the required threshold. A single session is defined as the time between a gambler placing a wager on a certain game and completing the last wager on the game before the end of the same calendar day.

The IRS also agreed to allow gambling institutions to use “gaming days” instead of calendar days for reporting periods if its use is uniform. Gaming days are generally used for other accounting purposes.

Gambling Win Loss Statement Taxes

Finally, the new final regulations did not include proposed rules that applied to electronically tracked systems for slot machines. The proposed regulations required reporting for winnings at least $1,200 within a calendar day session. However, the casino industry successfully argued that the technology would not support this and that it would “chill customer use.” Count this as a win for the casinos.